Tallinna Kaubamaja Group (TKM1T:TLX) is in the business of retail, wholesale trade and rental activity. The Group companies contribute more than one tenth of retail trade in Estonia, therefore it’s quite important to pay attention to the macroeconomic environment in Estonia. The Company operates in five business segments: supermarkets, department stores, footwear, cars and real estate. Most of the revenue comes from the fairly cyclical consumer driven segments supermarkets and department stores.

Macro and charting

Tallinna Kaubamaja main revenue comes from Estonia; therefore we should take a brief look at some macroeconomic factors that influence retail sales.

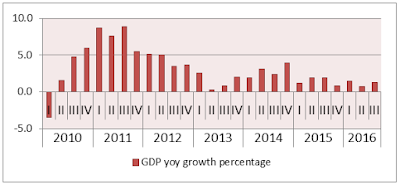

During

the aftermath of the 2008-2009 crises Estonia’s GDP had a good growth rate in

the years 2011-2012. After 2013 the growth rate has been slower and more

stable. Year-end growth rate figures have been positive since 2010. Positive GDP

growth in Estonia is probably going to continue at a similar or somewhat lower

rate.

Figure 1: GDP growth rate is positive for retail in Estonia, data source:

Statistics Estonia

Although

the average wage has been rising quite fast in the last few years (and with it

the wage costs for the company), the net effect is positive. As the average

wage rises, people have more discretionary income to spend at retail stores and

this drives revenue growth for the retail sector.

With

the macro environment generally supportive to retail sales, let’s move further

to take look at the company’s stock price movement.

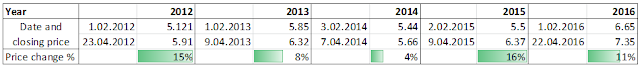

Looking

at the stock price at the Reuters website, with dividend payments

enabled, one can see a clearly visible spike every year, which coincides with

the yearly dividend payment.

Taking into account that Tallinna Kaubamaja pays

dividends in April and the annual report is released at the end of January,

there seems to be a pattern emerging for a short term strategy. Looking at the

price change for the last five years between the first trading day of February

and the day before the ex-dividend date in April (Table 1), we can see that the

change is indeed positive for the last five years and over 10% for three of the

five years.

This type of change has a

very high change of reoccurring, if there is no major economic slowdown in the

next three months. Therefore this strategy might be considered for a short term

trade, if the stock has no major fundamental problems this year and the

dividend is not reduced. For a longer term trade it is better to wait for a

month or two after the dividend payment, as we can see from the stock chart. After

the dividend payment the stock price usually falls and that opens a buying

opportunity for the long term holder.

Fundamentals

The following analysis is

based on numbers from the Consolidated Interim Report for the fourth quarter

and 12 months of 2016 (unaudited), which is available at the Nasdaq Baltic website.

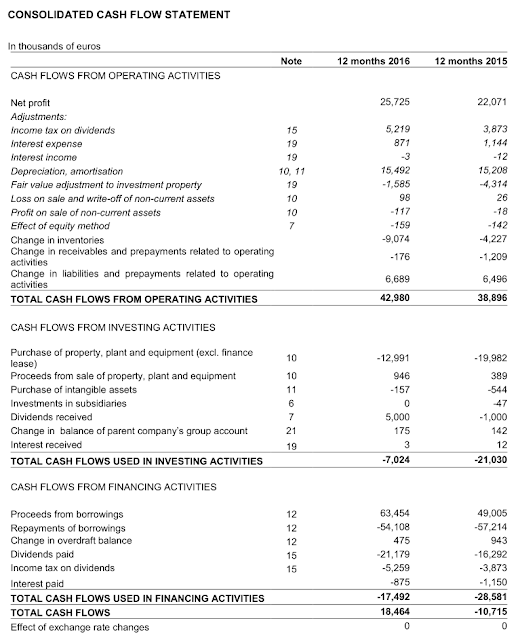

First, when looking at cash

flow it is good to see, that total cash flows is positive

18,4M, when comparing to a decrease in cash by 10,7M in 2015. This supports the

idea that dividends will be paid this year. The increase was mainly due to

larger operating cash flows, smaller investing cash flows (decrease in purchase

of property, plant and equipment)

and less cash used in financing activities (larger proceeds from borrowings).

Although the purchase of

PPE decreased, important investments were still made in the supermarket and

department store segments. They opened new Selver stores in three locations (and

closed only one) and additionally they renovated multiple stores. In case the

chosen locations are good, the stores will increase revenue and profit next

year. Also the Kaubamaja e-shop and e-Selver service expansion might benefit

growth in future years. The last 12 month cash flow supports the continuation

of the dividend.

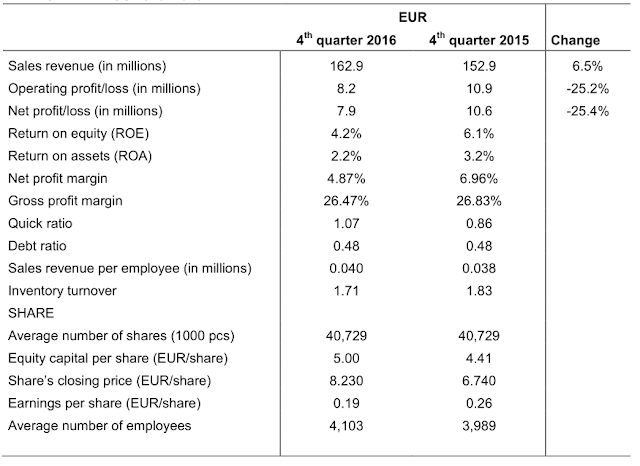

Second, looking at the

financial ratios, for the 12 months, we see EPS increased

in 2016 to 0.63, compared to 0.54

a year ago. Revenue grew by 7.7%, operating profit

increased 17.6% and net profit increased 16.6%. ROE, ROA, the net profit margin

and gross profit margin all increased. The quick ratio rose and the debt ratio

remained the same, which is positive for the balance sheet. Overall the 12 month

financial ratios point to a continuation of the dividend or even a possible

increase.

The fourth quarter of 2016

shows a decline in operating profit and net profit, when comparing to the

fourth quarter of 2015. ROE, ROA, net profit margin and gross profit margin are

negatively affected. Although the company points out that the lower profit was

mainly due to revaluation of the Group’s assets, a lower margin primarily due

to public procurements in the car segment and performance pay calculated in the

last quarter to the employees for overall good annual results, it would be

prudent to follow up on the profit margin comparison in the next quarterly

report and see if the profit decline continues when compared to the same

quarter of last year.

The balance sheet is in a good condition, cash flow is positive and financial ratios are encouraging. The company should have no trouble in paying the dividend this year. Before taking a longer term position, it is recommended to see, if the fourth quarter YoY profit decline continues into the first quarter.

Conclusion

The current environment

with global indexes at all-time high and political uncertainty, suggest caution

is to be taken in smaller, less liquid markets. However the macro fundamentals

in Estonia seem to be supportive and the company fundamentals are encouraging,

therefore a short term trade has

high chances of success. It is recommended to buy the stock near or around the

current level - 8.7€ or lower if possible, during

the first days of February, with an exit one day before the ex-dividend in

April.

Later, at least one month

after the dividend payment, the environment should be re-evaluated and the

stock bought at a similar or somewhat lower price, depending on Estonian

macroeconomic and company specific developments. In case further caution is necessary,

the next quarterly report should be read, to confirm that the profit is not

declining further.